Monster TV

Polecamy w Monster TV

Artykuły tylko dla bojowników JM (+18)

Zobacz galerię

Kto jest online?

Ale zawsze możesz się zarejestrować.

Gościmy obecnie 7996 osób, w tym 1452 rejestrowych bojowników walki z powagą.

Ostatnio dołączył do nas bojownik william1

Mistrzowie Internetu – Święte słowa, pokaż je swojej dziewczynie

W dzisiejszym odcinku m.in. jak dostać się do piwa w tym sklepie; polski program kosmiczny; ile istnieje płci; kariery dzieci komunistycznych dygnitarzy w polskiej TV; nowa polska wojenka o alkohol na stacjach oraz jeśli ci smutno, to pomyśl o tym chłopaku w przedstawieniu i jego roli.

Najmocniejsze cytaty – Andrzej Duda powiedział, co myśli o Donaldzie Trumpie po ich spotkaniu

Dzisiaj:

- Andrzej Duda powiedział, co myśli o Donaldzie Trumpie po ich spotkaniu

- Obajtek żali się, że jest śledzony i inwigilowany

- Nowy burmistrz Zakopanego zapowiada, że to koniec z Sylwestrem Marzeń

- Ryszard Petru tłumaczy, że bez sprzedaży alkoholu stacje benzynowe nie przetrwają

- Olechowski alarmuje! Nowe stroje polskich olimpijczyków przypominają flagę Rosji

Nie nazywaj mnie karłem! – rozmawiamy z Dandrisem, najmniejszym z największych bojowników Joe Monstera

Oto człowiek mały ciałem, ale wielki charakterem! Dandris to joemonsterowy bojownik, uczestnik zlotów, ale też filmowy aktor i rozrabiaka. Postanowiliśmy porozmawiać z nim o jego pracy, a także codziennych sprawach, z jakimi musi mierzyć się osoba niskorosła.

Za mocno kichnąłem i coś strzeliło mi w plecach – Ludzie, którzy mieli bardzo zły dzień

Pechowi ludzie tworzą tę pechową serię. Jeśli w życiu Ci nie idzie, to zobacz, że inni mają jeszcze gorzej.

Krótki dżołk

Nie udał się strajk listonoszy Poczty Polskiej. Okazuje się, że zamiast postulatów zostawili awizo.

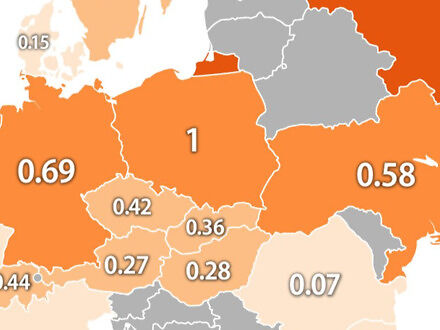

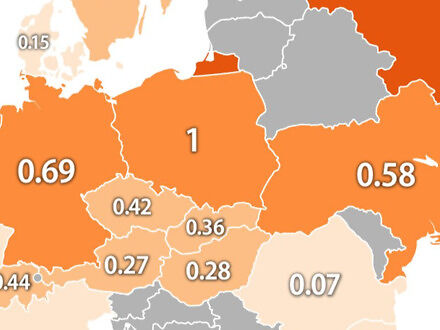

W którym roku Polki uzyskały prawo do głosowania – Kolekcja intrygujących map

W dzisiejszym odcinku m.in. 25 najstarszych demokracji na świecie, obecność wojskowa państw spoza Afryki na terenie tego kontynentu oraz stopień zniszczenia niemieckich miast w czasie II wojny światowej.

Kolekcja interesujących zdjęć - stylowa kiecka za 4 miliony zielonych

W dzisiejszej odsłonie „Kolekcji interesujących zdjęć” znajdziecie, między innymi, idealny punkt widokowy, pewną amerykańską parę rekordzistów oraz nagą księżną z okładki.

15 sytuacji, których trzeba doświadczyć, aby w pełni je zrozumieć

Nigdy tak naprawdę nie wiesz, przez co przechodzi inna osoba, dopóki sam nie przeżyjesz czegoś podobnego.

Ludzie dzielą się najbardziej szalonymi sekretami rodzinnymi, które niespodziewanie odkryli

3 571

26

Czytając poniższe historie można dojść do wniosków, że faktycznie z rodziną to się najlepiej na zdjęciu wychodzi.

Uzdolnione domowe „złote rączki” i ich domowe aranżacje

Czasami już sama myśl o remoncie domu wydaje się przerażająca. Czas, brud, syf, wysiłek, no i koszt – to składowe odnowienia każdego mieszkania. Najłatwiej powierzyć remont fachowcom, ale jeżeli znajdzie się odrobina czasu i pomysłu, warto podjąć się samemu tego wyzwania. Najlepsi i najbardziej dumni ze swoich prac chwalą się na Reddicie swoimi dziełami...

GIF-y, po obejrzeniu których powiesz: „Wow! Tego się nie spodziewałem” IX

Ale że co? Ale że jak to? Jak to się stało?

Patrzenie się na te zwierzaki grozi poprawą humoru na resztę dnia – Koty bez kontekstu

1 426

17

Zupełnie bez kontekstu, bez historii, bez wytłumaczenia, niepowiązane ze sobą. Po prostu koty będące kotami.

Jak dobrze znasz gwarę krakowską?

17 991

221

Kraków, dawna stolica polski i miasto wielu królów. Jak każdy ważniejszy region posiada on swoją unikalną gwarę, z którą mieszkańcy innych regionów niekoniecznie muszą być zaznajomieni. Dzisiaj to sprawdzimy i przekonamy się, czy potraficie mówić "po krakosku".

Ładne dziewczyny z ładnymi naszyjnikami

Pięknej dziewczynie dobrze we wszystkim, a każdy strój zyskuje dzięki biżuterii i drobnym dodatkom. Ładny naszyjnik podkreśla smukłą szyję, a przy odpowiedniej długości – również dekolt.

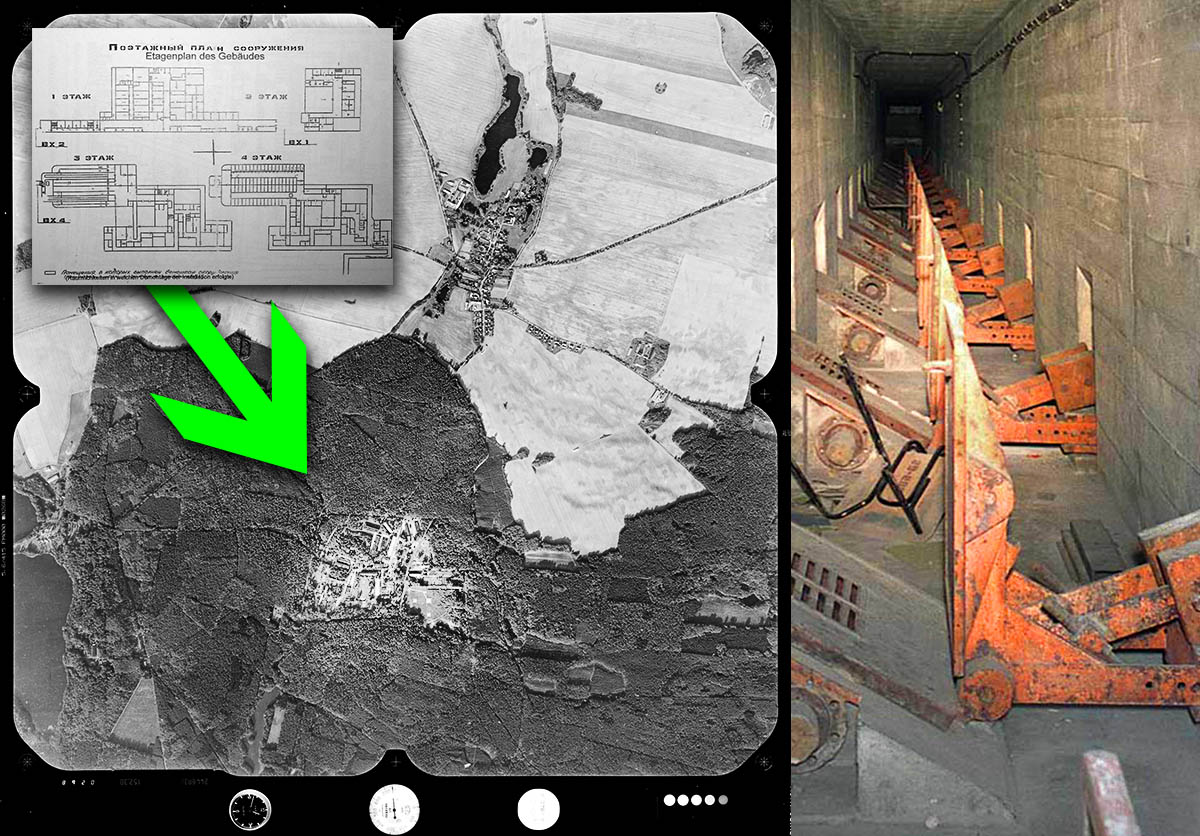

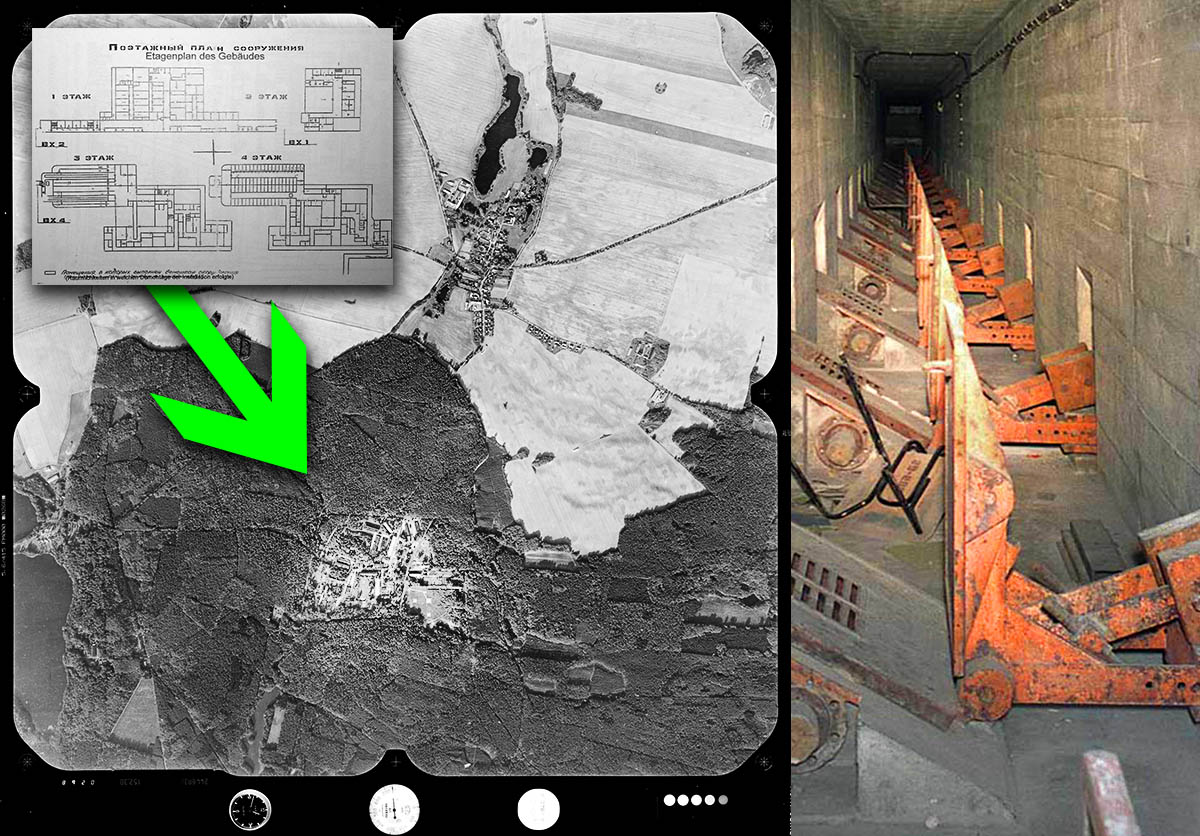

Dlaczego Niemcy i Rosjanie ukrywali istnienie tego miejsca przez dziesięciolecia - tuż przy polskiej granicy

Tuż przy naszej zachodniej granicy leży jeden z do niedawna najbardziej tajemniczych kompleksów wojskowo-przemysłowych. Ze względu na jego przeznaczenia, istnienie tego miejsca utrzymywano w tajemnicy przed światem przez ponad pół wieku. Do dzisiaj w internecie można znaleźć tylko zdawkowe informacje na temat tego miejsca, więc istnieje duże prawdopodobieństwo, że nie mieliście o nim pojęcia!

13 szokujących rzeczy, które musisz wiedzieć o ciemnej stronie internetu

Internet, który znamy i używamy to tylko wierzchołek góry lodowej. Jeśli chcesz kupić sobie nerkę albo wynająć płatnego zabójcę, musisz zagłębić się w odmęty Deep Web. Oprócz nielegalnych rzeczy można tam również znaleźć parę przydatnych.

#1. Deep Web jest olbrzymi

"Kiedy miałam 17 lat, zdiagnozowano u mnie schizofrenię, teraz w ramach terapii maluję swoje wizje"

Schizofrenia to choroba zmieniająca całe życie - ciężka dla samego chorego, powoduje brak zrozumienia u innych i odosobnienie. 18-letnia Kate stara się ją udobruchać malując swoje wizje i zwidy. To zdrowym daje pewne wyobrażenie z czym muszą się zmagać chorzy na tę chorobę. Aż trudno pojąć, jak to można znieść.

Największe obciachy – Ludziom nie podobają się stroje polskich olimpijczyków zaprezentowane przez firmę Adidas

Dzisiaj:

- Zniszczyli ule, bo chcieli spróbować miodu

- Jeden z kandydatów na wójta dowoził wyborców, a kiedy drugi próbował go powstrzymać, został potrącony

- Radio Zet oskarżyło Stanowskiego, że jest sponsorowany przez Putina. Potem usunęli artykuł i przeprosili

- Sam rektor uczelni Collegium Humanum mógł zdobyć doktorat w nie do końca uczciwy sposób

Najdziksze newsy tygodnia – Amerykański ochotnik walczący dla Rosjan został pobity na śmierć przez Rosjan

W dzisiejszym odcinku:

- zakaz palenia maryhuaenen podczas Oktoberfestu

- pijane sępy

- biegacze oszuści zdyskwalifikowani

- Amerykanin walczący po stronie Rosjan zabity przez Rosjan

- zakaz sprzedaży alkoholu na stacjach benzynowych

Oto pięciu „frajerów”, którzy dali się zrobić w trąbę i stracili fortunę na zakup perfidnych fałszywek

Dobry sprzedawca opchnie ci nawet najbardziej niedorzeczny produkt,

wcześniej zaszczepiwszy ci przekonanie, że przedmiotu tego bardzo

potrzebujesz i tylko skończony głupek nie skorzystałby z takiej

okazji. Potem oczywiście okaże się, że twoje okazyjnie nabyte

trofeum to zwykły bubel. A potem, trzymając w garści sygnet z

tombaku, z wywieszonym ozorem szukać będziesz tego faceta z

akordeonem, który wcisnął ci to dziadostwo. Na takie numery z

łatwością nabierają się również kolekcjonerzy sztuki, czyli

osoby, które to teoretycznie powinny być szczególnie uwrażliwione

na oszustwa. Oto kilku takich naiwniaków, co to się dali nabić w

butelkę.

Jeśli rozumiesz te memy, to czas na kolonoskopię

Sentymentalna podróż w czasie do epoki, kiedy byliśmy dziećmi, nie płaciliśmy podatków, nie bolały nas plecy i cieszyliśmy się stanem konta na SKO. Wkładajcie rajstopki i rękawiczki na sznurku i jedziemy!

Tanie rzeczy, które okazały się drogie lub nawet bezcenne

Czasem tak niewiele potrzeba, by zdobyć coś wartościowego lub bezcennego. Poniżej historie 15 ludzi, do których uśmiechnęła się fortuna.

| Z archiwów JM |

|

|

Monster Galeria: Nawet AI nie przeskoczy

Najpotworniejsze ostatnio

Login

Nie masz jeszcze konta na tej najlepszej na świecie stronie?! Jakże tak można?!

Jako zarejestrowany bojownik JM, będziesz miał parę bonusów:

- strona będzie cie witać

- zmienisz sobie wygląd strony

- od czasu do czasu dostaniesz od nas maila

- będziesz mógł popisać się na forum

- będziesz recenzentem i oceniaczem

- skomentujesz nas szczerze

- obejrzysz w całości słynną MonsterGalerię, teraz to 310 198 obrazków. I wiem, że zawsze chciałeś ją obejrzeć…

- włączysz sobie na pełen regulator Szafę Grającą, teraz ponad 1563833 pliczków.

Krótkie dżołki

Nie udał się strajk listonoszy Poczty Polskiej. Okazuje się, że zamiast postulatów zostawili awizo.

* * *

Sztuczne ognie dla gamoni: frajerwerki.

* * *

Film był tak nudny, że na sali całowali się nawet nieznajomi ludzie.

* * *

Przedwczoraj był Dzień Książki. Postanowiłem go uczcić. Jestem już na trzeciej stronie.

* * *

Patrycja tak bardzo powiększyła sobie wargi, że faceci przestali zwracać uwagę na wąsy.

* * *

* * *

Sztuczne ognie dla gamoni: frajerwerki.

* * *

Film był tak nudny, że na sali całowali się nawet nieznajomi ludzie.

* * *

Przedwczoraj był Dzień Książki. Postanowiłem go uczcić. Jestem już na trzeciej stronie.

* * *

Patrycja tak bardzo powiększyła sobie wargi, że faceci przestali zwracać uwagę na wąsy.

* * *

Zakazane strony

Najlepsze komentarze

„Niesamowite, co?”

by pelnomocnik

680

„Niesamowite, co?”

by pelnomocnik

680

„Stop making stupid people famous.”

by CrySphinx

616

„Stop making stupid people famous.”

by CrySphinx

616

„A kto to wraca z pracy ?

Pani maruda , niszczycielka dobrej zabawy

pogromczyni uśmiechów dzieci...”

by Marzenie_wieloryba

504

„A kto to wraca z pracy ?

Pani maruda , niszczycielka dobrej zabawy

pogromczyni uśmiechów dzieci...”

by Marzenie_wieloryba

504

„Mega szacun”

by neverxxxalone

475

„Mega szacun”

by neverxxxalone

475

„Można, ale pod warunkiem, że masz wujka w policji...”

by skaba

402

„Można, ale pod warunkiem, że masz wujka w policji...”

by skaba

402

Sprawdź swoją wiedzę!